These AI stocks aren’t just hype. They offer solid income and cutting-edge technology.

Artificial intelligence is one of those catchy phrases that continues to grab investors’ attention. Like 5G, it tugs on the sleeves of those looking to get in on cutting-edge technology. While it is a very important sector of technology, investors need to be wary of hype and focus on reality before buying AI stocks.

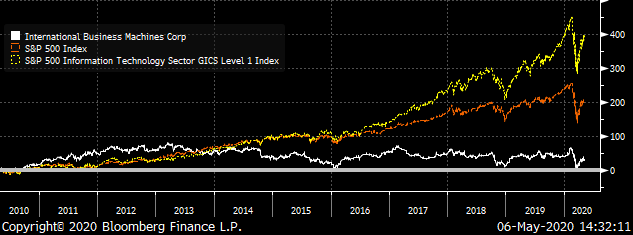

Take, for example, International Business Machines (NYSE:IBM). IBM has been on the front line of AI with its Watson-branded products and services. Sure, it did a bang up job on Jeopardy and it partners with dozens of companies. But for IBM shareholders, Watson is not a portfolio favorite.

Over the past five years, IBM has lost 28.7% in price compared to the S&P 500’s gain of 37.5% and the S&P Information Technology Index’s gain of 130%. And over the past 10 years, IBM’s AI leadership has generated a shareholder loss of 3.4%.

IBM (White), S&P 500 (Red) & S&P 500 Information Technology (Gold) Indexes Total Return

But AI is more than just a party trick like Watson. AI brings algorithms into computers. These algorithms then take internal and external data, and in turn process decisions behind all sorts of products and services. Think for example something as simple as targeted ads. Data is gathered and processed while you simply shop online.

But AI can go much further. Think, of course, of autonomous vehicles. AI takes all sorts of input data and the central processor makes calls to how the vehicle moves — and at what speed and direction.

Or in medicine, AI brings quicker analysis of symptoms, diagnostic data and tests.

And the list goes on.

So then what do I bring to the table as a human? I have found ten AI stocks that aren’t just companies using AI. These are companies to own and follow for years — complete with dividends along the way.

- Vanguard Information Technology ETF (NYSEARCA:VGT)

- AT&T (NYSE:T)

- Verizon (NYSE:VZ)

- Samsung (OTCMKTS:SSNLF)

- Ericsson (NASDAQ:ERIC)

- Microsoft (NASDAQ:MSFT)

- Digital Realty Trust (NYSE:DLR)

- Corporate Office Properties (NYSE:OFC)

- Hercules Capital (NYSE:HTGC)

- Amazon (NASDAQ:AMZN)

The Index That Tracks AI Stocks

Let’s start with the index of the best technology companies found inside that S&P Information Technology index cited earlier. The Vanguard Information Technology ETF (NYSEARCA:VGT) synthetically invests in the leaders of that index. It should be the starting point for all technology investing — it offers a solid foundation for portfolios.

Vanguard Information Technology ETF (VGT) Total Return

The exchange-traded fund continues to perform well. Its return for just the past five years runs at 141.1% for an average annual equivalent return of 19.2%. This includes the major fall in March 2020.

Communicating the Data

Before I move to the next of my AI stocks, it’s important to note that data doesn’t just get collected. It also has to be communicated quickly and efficiently to make processes work.

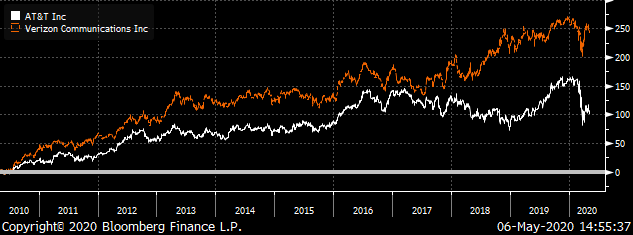

Take the AI example mentioned earlier for autonomous vehicles. AI driving needs to know not just what is in front of the vehicle, but what is coming around the next corner. This means having dependable data transmission. And the two leaders that make this happen now — and will continue to do so with 5G — are AT&T (NYSE:T) and Verizon (NYSE:VZ).

AT&T (White) & Verizon (VZ) Total Return

Much like other successful AI stocks, AT&T and Verizon have lots of communications services and content. This provides some additional opportunities and diversification — but can limit investor interest in the near term. This is the case with AT&T and its Time Warner content businesses. But this also means that right now, both of these stocks are good bargains.

And they have a history of delivering to shareholders. AT&T has returned 100% over the past 10 years, while Verizon has returned 242%.

Equipment, Lots of Equipment

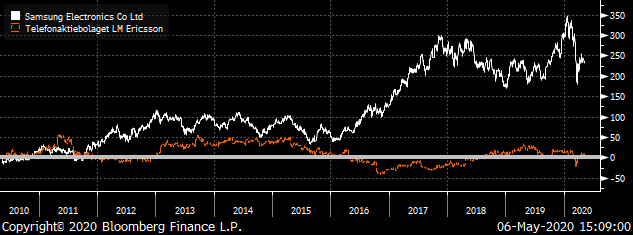

AI takes lots of equipment. Chips, processors and communications gear all go into making AI computers and devices. And you should buy these two companies for their role in equipment: Samsung Electronics (OTCMKTS:SSNLF) and Ericsson (NASDAQ:ERIC).

Samsung is one of the global companies that is essential for nearly anything that involves technology and hardware. Hardly any device out there isn’t a either a Samsung product or has components invented and produced by Samsung.

And Ericsson is one of the leaders in communications gear and systems. Its products makes AI communications and data transmission work, including on current 4G and 5G.

Samsung Electronics (White) & Ericsson (Red) Total Return

Over the past 10 years Samsung has delivered a return of 235.4% in U.S. dollars while Ericsson has lagged, returning a less-than-stellar 6.5%.

Both have some challenges in their stock prices. Samsung’s shares are more challenging to buy in the U.S. And Ericsson faces economic challenges as it’s deep in the European market. But in both cases, you get great products from companies that are still value buys.

Samsung is valued at a mere 1.2 times book and 1.3 times trailing sales, which is significantly cheaper than its global peers. And Ericsson is also a bargain, trading at a mere 1.3 times trailing sales.

Software, Lots of Software

To make AI work you need lots of software. This brings in Microsoft (NASDAQ:MSFT). The company is one of the cornerstones of software — its products have all sorts of tech uses.

And AI — especially on the move — needs quick access to huge amounts of data in the cloud. Microsoft and its Azure-branded cloud fits the bill.

Microsoft (MSFT) Total Return

Microsoft, to me, is the poster child of successful technology companies. It went from one-off unit sales of packaged products to recurring income streams from software subscriptions. Now it’s pivoting to cloud services. And shareholders continue to see rewards. The company’s stock has returned 702.7% over the past 10 years alone.

The AI Cloud Needs Grounding

AI and the cloud are integral in their processing and storage of data. But beyond software and hardware, you need to stack off the hardware, complete with power and climate controls, transmission lines and wireless capabilities.

This means data centers. And there are two companies set up as real estate investment trusts (REITs) that lead the way with their real estate and data centers. These are Digital Realty Trust (NYSE:DLR) and Corporate Office Properties (NYSE:OFC).

Digital Realty has the right name, as Corporate Office Properties doesn’t tell the full story. The latter company has Amazon (NASDAQ:AMZN) and its Amazon Web Services (AWS) as exclusive clients in core centers, including the vital hub in Northern Virginia.

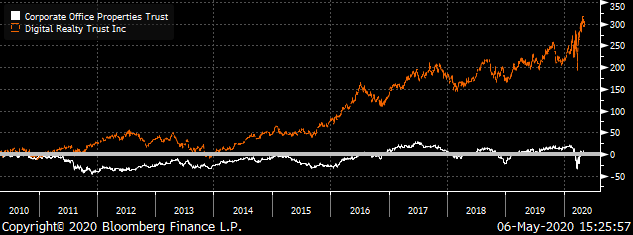

And the stock-price returns show the power of the name. Digital Realty has returned 310.9% against a loss of 0.9% for Corporate Office Properties.

Corporate Office Properties (White) & Digital Realty (Red) Total Return

But this means that while both are good buys right now, Corporate Office Properties is a particular bargain. The stock price is at a mere 1.7 times the company’s book value.

AI Stocks for Up-and-Coming Technology

Now I’ll get to the newer companies in the AI space. These are the companies that are in various stages of development. Some are private now, or are pending public listings. Others are waiting for larger companies to snap them up.

Most individual investors — unless they have a net worth nearing $1 billion — don’t get access. But I have a company that brings this access, and it’s my stock for the InvestorPlace Best Stocks for 2020 contest.

Hercules Capital (NYSE:HTGC) is set up as business development company (BDC) that provides financing to all levels of technology companies. Along the way, it takes equity participation in these companies.

It supports hundreds of current technology companies using or developing AI for products and services — along with a grand list of past accomplishments. The current portfolio can be found here.

I have followed this company since its early days. I like that it is very investor focused, complete with big dividend payments throughout the many years. And it has returned 184.3% over just the past 10 years alone.

One Word: Amazon

Who doesn’t buy goods and services from Amazon? I am a prime member with video, audio and book services. And I also have many Alexa devices that I use throughout the day. While I don’t contract directly with its AWS, I use its cloud storage as part of other services. Few major companies that are part daily life make use of AI more than Amazon.

The current lockdown mess has made Amazon a further necessity. Toilet paper, paper towels, cleaning supplies, toothpaste, soap and so many other items are sold and delivered by Amazon.

And I also use the platform for additional digital information from the Washington Post. Plus, I get food and other household goods from Whole Foods, and products for my miniature dachshund, Blue, come from Amazon.

This is a company that I have always liked as a consumer, but didn’t completely get as an investor. Growth for growth’s sake was what it appeared to be from my perspective. But I have been coming to a different understanding of what Amazon means as an investment.

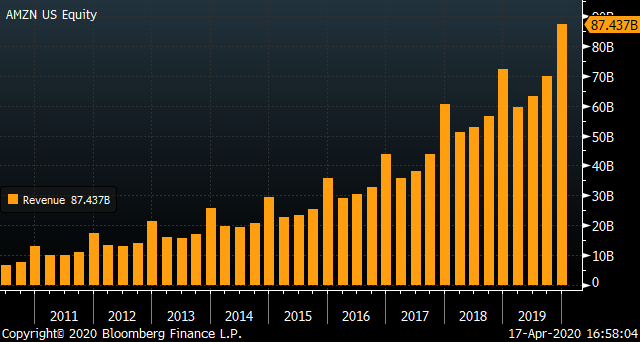

It really is more of an index of what has been working in the U.S. for cloud computing and goods and services. And the current mess makes it not just more relevant — but a necessity. Its proof comes from the sales that keep rolling up for the company on real GAAP terms.

Amazon Sales Revenue (GAAP)